從過去幾天的探索,我們發現 NautilusTrader 雖然提供的是 Python 使用介面,但核心運算其實是由 Rust 驅動。

這種設計的好處,是能讓開發者享受 Python 的易用性,同時又能利用 Rust 的高效能與安全性。

在 NautilusTrader 的架構演進中:

觀察他們的 GitHub,可以發現 v2 的第一個 commit 才在上個月 18 號,轉移工作才剛開始,因此本次我們將聚焦在 PyO3 的介紹與實作,先從原理與範例掌握概念,再回頭比較 NautilusTrader v1 的做法。

PyO3 套件專門提供 Rust/Python 相互呼叫的函式庫,封裝了底層 FFI 所需的型別轉換與呼叫規則,非常適合用來將 計算密集型的邏輯交給 Rust 處理,而非全交由 Python。

今天會先示範一個例子,之後幾天會做更深度的討論

首先 先安裝 maturin 可以參考底下網站 選擇你想要的方式

https://pyo3.rs/v0.25.1/getting-started.html

安裝完後,建立ㄧ個新的專案夾

進入專案夾

maturin init

選擇 Pyo3

接著安裝 Pyo3套件

cargo add pyo3

修改 Cargo.toml

[package]

name = "vwap_pnl"

version = "0.1.0"

edition = "2021"

[lib]

name = "vwap_pnl"

crate-type = ["cdylib"]

[dependencies]

pyo3 = { version = "0.22", features = ["extension-module"] }

numpy = "0.22"

[profile.release]

codegen-units = 1

lto = "fat"

opt-level = 3

撰寫 Rust

use numpy::{PyArray1, PyReadonlyArray1};

use pyo3::prelude::*;

use pyo3::types::{PyDict, PyModule};

#[pyfunction]

fn compute_vwap_pnl<'py>(

py: Python<'py>,

bid: PyReadonlyArray1<'py, f64>,

ask: PyReadonlyArray1<'py, f64>,

side: PyReadonlyArray1<'py, i8>, // 1=buy, -1=sell

size: PyReadonlyArray1<'py, f64>, // >0

) -> PyResult<Bound<'py, PyDict>> {

// zero-copy slice views

let bid = bid.as_slice()?;

let ask = ask.as_slice()?;

let side = side.as_slice()?;

let size = size.as_slice()?;

let n = bid.len();

if ask.len() != n || side.len() != n || size.len() != n {

return Err(pyo3::exceptions::PyValueError::new_err("array length mismatch"));

}

let mut fill_price = vec![0.0f64; n];

let mut pnl_per_fill = vec![0.0f64; n];

let mut notional_sum = 0.0f64;

let mut qty_sum = 0.0f64;

use std::collections::VecDeque;

// (qty, px): qty>0 long lot, qty<0 short lot

let mut lots: VecDeque<(f64, f64)> = VecDeque::new();

let mut realized_pnl = 0.0f64;

for i in 0..n {

let s = side[i] as i32;

let q = size[i];

if q <= 0.0 {

continue;

}

let px = if s > 0 { ask[i] } else { bid[i] };

fill_price[i] = px;

notional_sum += px * q;

qty_sum += q;

if s > 0 {

// BUY:先對沖 short

let mut remain = q;

while remain > 0.0 {

if let Some(&(lot_q, lot_px)) = lots.front() {

if lot_q < 0.0 {

let match_q = remain.min(-lot_q);

realized_pnl += (lot_px - px) * match_q; // short pnl

pnl_per_fill[i] += (lot_px - px) * match_q;

let new_q = lot_q + match_q; // lot_q<0 → toward 0

lots.pop_front();

if new_q != 0.0 {

lots.push_front((new_q, lot_px));

}

remain -= match_q;

} else {

break;

}

} else {

break;

}

}

if remain > 0.0 {

lots.push_back((remain, px)); // 新增 long lot

}

} else {

// SELL:先對沖 long

let mut remain = q;

while remain > 0.0 {

if let Some(&(lot_q, lot_px)) = lots.front() {

if lot_q > 0.0 {

let match_q = remain.min(lot_q);

realized_pnl += (px - lot_px) * match_q; // long pnl

pnl_per_fill[i] += (px - lot_px) * match_q;

let new_q = lot_q - match_q;

lots.pop_front();

if new_q != 0.0 {

lots.push_front((new_q, lot_px));

}

remain -= match_q;

} else {

break;

}

} else {

break;

}

}

if remain > 0.0 {

lots.push_back((-remain, px)); // 新增 short lot

}

}

}

let vwap = if qty_sum > 0.0 { notional_sum / qty_sum } else { 0.0 };

// 以 *Bound 風格* 建立回傳物件

let out = PyDict::new_bound(py);

let fill_price_arr = PyArray1::from_vec_bound(py, fill_price);

let pnl_per_fill_arr = PyArray1::from_vec_bound(py, pnl_per_fill);

out.set_item("fill_price", fill_price_arr)?;

out.set_item("pnl_per_fill", pnl_per_fill_arr)?;

out.set_item("vwap", vwap)?;

out.set_item("realized_pnl", realized_pnl)?;

Ok(out)

}

#[pymodule]

fn vwap_pnl(_py: Python, m: &Bound<PyModule>) -> PyResult<()> {

m.add_function(wrap_pyfunction!(compute_vwap_pnl, m)?)?;

Ok(())

}

建置專案,並安裝套件以提供Python呼叫

maturin develop

撰寫測試腳本

import time

import numpy as np

import vwap_pnl

# 造一批資料

N = 1_000_000

rng = np.random.default_rng(7)

mid = 30000 + 1000 * rng.standard_normal(N)

spr = np.clip(rng.normal(5, 1, N), 0.1, None)

bid = (mid - spr/2).astype(np.float64)

ask = (mid + spr/2).astype(np.float64)

side = rng.choice([1, -1], size=N, p=[0.5, 0.5]).astype(np.int8)

size = np.abs(rng.normal(0.01, 0.003, N)).astype(np.float64)

# PyO3

t0 = time.perf_counter()

out = vwap_pnl.compute_vwap_pnl(bid, ask, side, size)

t1 = time.perf_counter()

print("[PyO3] vwap:", out["vwap"], "realized_pnl:", out["realized_pnl"], "time:", round(t1-t0, 4), "s")

# 參考:純 Python(慢)

def py_compute(bid, ask, side, size):

fill_price = np.empty_like(bid)

realized = 0.0

pnl_per = np.zeros_like(bid)

from collections import deque

lots = deque()

for i in range(len(bid)):

s = int(side[i]); q = float(size[i])

if q <= 0:

fill_price[i] = np.nan; continue

px = ask[i] if s > 0 else bid[i]

fill_price[i] = px

if s > 0:

remain = q

while remain > 0 and lots and lots[0][0] < 0:

lot_q, lot_px = lots[0]

match_q = min(remain, -lot_q)

realized += (lot_px - px) * match_q

pnl_per[i] += (lot_px - px) * match_q

lot_q += match_q

lots.popleft()

if lot_q != 0: lots.appendleft((lot_q, lot_px))

remain -= match_q

if remain > 0: lots.append((remain, px))

else:

remain = q

while remain > 0 and lots and lots[0][0] > 0:

lot_q, lot_px = lots[0]

match_q = min(remain, lot_q)

realized += (px - lot_px) * match_q

pnl_per[i] += (px - lot_px) * match_q

lot_q -= match_q

lots.popleft()

if lot_q != 0: lots.appendleft((lot_q, lot_px))

remain -= match_q

if remain > 0: lots.append((-remain, px))

vwap = float(np.sum(fill_price * size) / np.sum(size))

return {"fill_price": fill_price, "pnl_per_fill": pnl_per, "vwap": vwap, "realized_pnl": float(realized)}

t0 = time.perf_counter()

out_py = py_compute(bid, ask, side, size)

t1 = time.perf_counter()

print("[PurePy] vwap:", out_py["vwap"], "realized_pnl:", out_py["realized_pnl"], "time:", round(t1-t0, 4), "s")

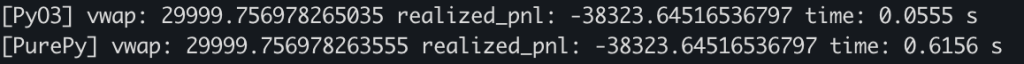

底下是腳本輸出結果 可以看到效能明顯提升

透過這次的範例,驗證了 PyO3 在高效能運算場景下的優勢,這種 Python 作為外層接口、Rust 作為核心引擎 的設計思路,能讓交易系統既保有靈活性,又能在毫秒級延遲的市場中保持競爭力。

接下來的幾天,我們會先介紹一下Rust,接著會實作一個簡單的python交易系統,完成後再根據其中可以用Rust優化的地方做加強,等我們足夠了解交易系統的架構後,就會來說明 NautilusTrader 的 V1 架構設計.